annual federal gift tax exclusion 2022

The federal estate tax exclusion is also climbing to more than 12 million per individual. The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021.

Gift Tax The Annual Exclusion And Estate Planning The American College Of Trust And Estate Counsel

Do you pay taxes when you receive a gift.

. You can give up to this amount in money or property to any individual per year without incurring a gift tax. Giftestate tax lifetime exemption increases from 117 million to 1206 million. When you file a gift tax return the IRS will decrease your remaining lifetime exclusion amount by the amount of your annual gift tax return.

The annual exclusion for 2014 2015 2016 and 2017 is 14000. Gift tax annual exclusion increases from 15000 to 16000. The annual exclusion applies to gifts to each donee.

This means that any taxable amount exceeding the. Few people owe gift tax. However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each beneficiary of their choosing before facing the federal gift tax.

The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. That means you can give up to 16000 to as many recipients as you want without having to pay any gift tax. The maximum credit allowed for adoptions for tax year 2022 is the amount of qualified adoption expenses up to 14890 up from 14440 for 2021.

With the passage of the Tax Cuts and Jobs Act this pool shrank considerably at least temporarily as the federal lifetime gift tax exemption amount more than doubled. Any person who gives away more than 16000 to any one person is technically required to file Form 709 the gift tax return. For 2022 the annual gift exclusion is being increased to 16000.

This increase to the federal estate and gift exemption amount to 12060000 means that estates of individuals who die in 2022 with combined. Wednesday March 2 2022. The amount you can gift to any one person without filing a gift tax form is increasing to 16000 in 2022 the first increase since 2018.

1 That means if you had the money you could whip out your checkbook and write 16000 checks to your mom your brother your sister your new best friends youll have lots of friends if you start giving away free money and you wouldnt have to pay a gift tax. Annual Gift Tax and Estate Tax Exclusions Are Increasing in 2022. The federal estate tax exclusion is also climbing to more than 12 million per individual.

The gift tax exclusion for 2022 is 16000 per recipient. Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts. The annual gift exclusion is applied to each donee.

In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift. The IRS generally isnt involved unless a gift exceeds 15000 16000 in 2022. Any gift above the exclusion is subject to.

News Release IR-2021-216 IRS announces 401k limit increases to 20500. After exceeding the 15000 there is a 1206 million federal estate tax exemption for 2022. Although there is near-universal acceptance of the importance of gifting.

For 2018 2019 2020 and 2021 the annual exclusion is. The 2022 federal estate and gift tax exemption has been increased to 12060000 up from 11700000 in 2021. The annual gift tax exemption allows taxpayers to give certain gifts without using the lifetime exemption amount.

This might be done in a single gift to each child or a series of gifts so long as the annual total to each child is not greater than. 27 rows The Annual Gift Tax Exclusion for Tax Year 2022 The gift tax limit for individual filers. That said the current higher exclusion amount in 2022 1206 million per individual and 2412 million per couple will sunset on December 31 2025 and could be lowered.

The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or. Even then it might only trigger extra paperwork. The IRS also increased the annual exclusion for gifts to 16000 in 2022 up from 15000.

Gifts to beneficiaries are eligible for the annual exclusion. If gifts are made through a trust the trust must be written to include crummey withdrawal power to qualify as a current. For example assume that in 2022 you give gifts totaling 16000 to each your three children for a total of 48000.

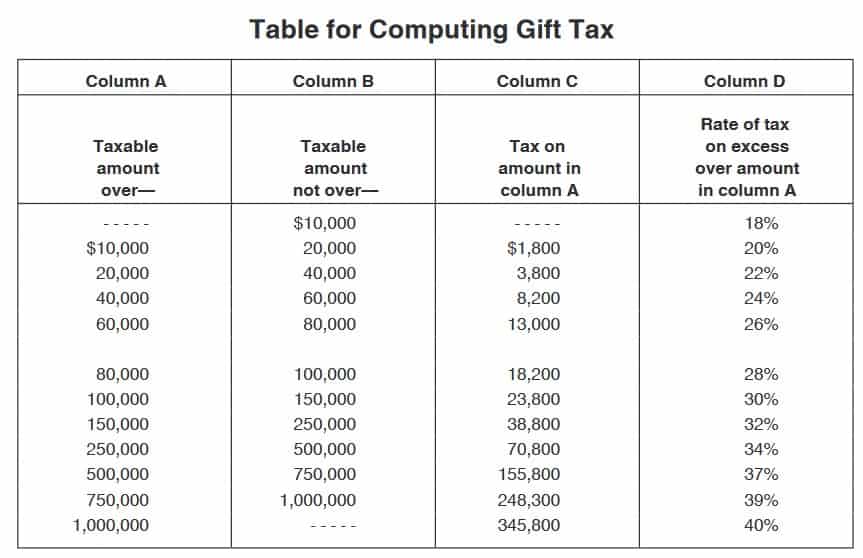

The annual gift tax exclusion is 16000 for 2022. 13 rows The gift tax rate for 2022 is 18-40. Annual Gift Tax Exclusion The IRS allows individuals to give away a specific amount of assets.

You can leave up. For 2022 the annual exclusion is 16000 per person up from 15000 in 2021. This amount is known as the annual exclusion amount which for 2022 is 16000 per beneficiary.

The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted. The IRSs announcement that the annual gift exclusion will rise for calendar year 2022 means that any person who gives away 16000 or less to any one individual anyone other than their spouse does not have to report the gift or gifts to the IRS. The federal government imposes a tax on gifts.

In 2022 the annual exclusion for Federal Gift Taxes increased to 16000 per person per year. The annual gift tax exclusion is 16000 for the 2022 tax year. The amount you can gift to any one person on an annual basis without filing a gift tax return is increasing to 16000 in 2022 the first increase since 2018.

This means that any person who gave away 16000 or less to any one individual anyone other than their spouse in 2022 does not have to report the gift or gifts to the IRS. In 2022 the annual gift tax exemption is increased to 16000 per beneficiary.

How To Leverage Your Marriage To Avoid Paying Gift Tax Gobankingrates

Gift Tax Explained 2021 Exemption And Rates

Gifting Time To Accelerate Plans Evercore

What Is The Tax Free Gift Limit For 2022

Gift Tax Limit 2022 What Is It And Who Can Benefit Marca

How To Give To Family And Friends And Avoid Gift Taxes Wtop News

Are You Ready For The 2021 Gift Tax Return Deadline Wegner Cpas

How Does The Gift Tax Work Personal Finance Club

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

How Can I Save On Taxes By Gifting Cash To Others

Attorney At Law 2022 Changes To Estate And Gift Tax Exclusions Announced Tbr News Media

What Is The Tax Free Gift Limit For 2022

Warshaw Burstein Llp 2022 Trust And Estates Updates

Learn About Estate And Gift Taxes The Hayes Law Firm

Irs What Is The Gift Tax And Who Benefits Fingerlakes1 Com